Let me vent! This is quite a story.

After recreating new CRA accounts for both of us, our passwords came in the mail. The agent was horrified when I told her that I did his taxes, and demanded we get this permission signed and uploaded right away. Despite this, CRA kept emailing JB saying he had to respond to them. JB had signed a paper saying that I could do his taxes.

After checking our mail, finally a new one-time passcode. It just isn't simple. Logging on, they had to send me a text code, and THEN I could log in with the new passcode. I found the 'letters' CRA claimed we hadn't responded to, unopened on his account.

I spent a half hour yesterday reading and printing mysterious messages from Canada Revenue Agency on our online MyAccount. Apparently we will owe 6-digits for 2020 taxes, since we did not respond to messages on MyAccount that we didn't know we had. I had suspected that they'd want the hard copy receipts, but since most of them were mine from laser eye surgery, I expected them to tell me.

When you do up you taxes on TurboTax, the program automatically divided receipts between both of our tax accounts. It's only fair, since we share finances. That's why it's JB's account that required medical receipts.

What a complicated system. I don't know how some seniors get this done if they don't have someone to help them.

I spent another two hours gathering and reprinting medical receipts for 2020, crafting a letter, and totalling medical receipts. I uploaded the letter to his account, and we will snail mail the receipts to CRA.

Sadly, the address of our tax office is in St. John's, Newfoundland. They've just had a major storm, as well as New brunswick.

|

| Terrible washouts out east |

UPDATE: CRA phoned Thurs., Nov. 25th.

I had another CRA phone call, the real deal when they quote their first name and employee number. They demanded I tell them the plan for repaying the $10,000 they say we owe.

I spent 15 minutes explaining the situation.

- We didn't get their 'letters' on the website.

- I borrowed from the Line of Credit and paid the amount owing from my 2019 error. It will take 5 - 10 days for them to receive our payment. $194.37 in interest for 2019's mistake.

- I have printed a letter outlining what has happened, that I've paid the 2019 overdue amount, and uploaded it to JB's tax return.

- I have copied my medical receipts from 2020, they are mostly mine, and snail mailed them to CRA in Newfoundland. Also, it will take until Dec. 1st to get our paperwork.

UPDATE: Nov. 28

I accidentally paid the 2019 amount we need to pay back from my line of credit to Joe's VISA not his CRA account. I phoned right away, and asked them to cancel that. Today, Sunday, the amount has gone into JB's VISA. I paid the right amount to his CRA account.

So, if they cancel the VISA amount, I'll have to repay the actual November VISA amount prior to the due date, or we will be charged interest on that!

UPDATE: Nov. 29

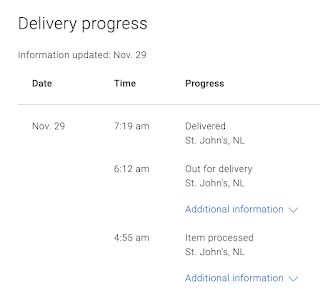

Our package of receipts for our 2021 taxes made it to the Newfoundland office, despite NL flooding. Whew!

UPDATE: Dec. 3 – Still waiting for RBC to reverse the mistaken payment I made.Finally, I had a message that they would accept our medical receipts for 2020, if I uploaded them. This is good news, although we sent them via Canada Post, tracked and securely delivered to a Newfoundland office a year ago.

I showed JB how to lay out the receipts for me, in order to scan them all. There were 14, but the most important ones were the cataract surgery I had. My $300/month healthcare plan doesn't cover this, nor does it cover my anxiety meds.

You should have seen us! He was down the hallway in the office, and I'd yell down saying, 'next' and he'd replace it. He'd yell back, 'OK' and I'd scan them remotely on my laptop app.

5 comments:

...it doesn't sound like fun.

What a headache.

Wow! I had better get in there soon.

Hari OM

Oh, I am so glad I fall between the cracks on this sort of stuff... no income, other than pension and falling well below the 'relief line' for having to pay tax. It's grit your teeth stuff I remember from working days and miss it not one jot! YAM xx

Yikes. Not fun at all.

Post a Comment